Manitoba probate for small estates offers a streamlined process for estates with limited assets, ensuring efficient management and distribution according to legal guidelines and the deceased’s will.

Understanding Probate in Manitoba

Probate in Manitoba is a legal process that validates a will and authorizes the executor to manage and distribute the estate according to the deceased’s wishes. It ensures the will is genuine and protects the estate from disputes. The process involves court oversight, particularly for larger or contested estates, but smaller estates may qualify for simplified procedures. Understanding probate is essential for executors and beneficiaries to navigate the legal requirements and ensure proper asset distribution. It is a critical step in settling an estate efficiently and lawfully in Manitoba.

Definition of a Small Estate in Manitoba

In Manitoba, a small estate is typically defined as one with a value below a specific threshold, often around $10,000, though exact limits may vary. This classification allows for a simplified probate process, reducing legal complexities and costs. Small estates usually consist of personal property, such as bank accounts, vehicles, or other assets, but exclude real estate or significant holdings. The definition is crucial for determining whether a streamlined administration process is applicable, making estate settlement more efficient for executors and beneficiaries.

The Probate Process for Small Estates

The probate process for small estates in Manitoba is designed to be efficient, involving court oversight to validate the will and ensure assets are distributed correctly.

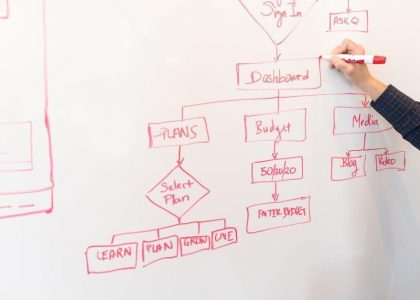

Overview of the Probate Process

The probate process in Manitoba involves court oversight to validate a will and appoint an executor or personal representative; It ensures the estate is managed legally and fairly. Key steps include submitting the will and required documents to the court, paying applicable fees, and providing notice to beneficiaries and creditors. The executor then gathers assets, settles debts, and distributes the remaining assets according to the will or legal guidelines. The court may require additional steps to finalize the process and close the estate formally.

Steps Involved in Probating a Small Estate

Probating a small estate in Manitoba begins with filing an application for probate or administration with the court. The executor or personal representative must submit the will, death certificate, and inventory of assets. Fees are paid, and notice is given to beneficiaries and creditors. The court reviews the application, and if approved, grants probate. The executor then gathers assets, settles debts, and distributes the estate according to the will or legal guidelines. Final reporting to the court and beneficiaries concludes the process, ensuring all legal requirements are met.

Legal Requirements and Forms

Probating a small estate in Manitoba requires specific legal forms, including the Application for Probate and Notice to Creditors, ensuring compliance with provincial estate laws and regulations.

Necessary Forms for Probate

Probating a small estate in Manitoba requires specific legal forms, such as the Application for Probate and Notice to Creditors. Additional forms may include an Inventory of Assets and an Affidavit of Execution, ensuring all legal requirements are met. These documents are essential for verifying the estate’s value,authenticating the will, and notifying relevant parties. Accuracy in completing these forms is crucial to avoid delays. Forms can typically be found on the Manitoba Courts website or through legal resources, simplifying the process for executors and personal representatives.

Fees Associated with Probate

Probate fees in Manitoba vary based on the estate’s complexity and value. Court fees for filing probate applications are typically a percentage of the estate’s value, while legal fees depend on the lawyer’s services. Additional costs may include appraisals and notices. For small estates, fees are generally lower, but they still require careful budgeting. Executors should review the Manitoba Courts fee schedule to understand potential expenses. These costs are essential to ensure the probate process is legally valid and properly managed, avoiding future disputes.

Role of the Executor or Personal Representative

The executor manages the estate, ensuring assets are distributed according to the will and legal requirements, while maintaining transparency and accountability throughout the probate process.

Duties of the Executor

The executor is responsible for managing the estate according to the will and legal requirements. Key duties include identifying and inventorying assets, paying debts, filing taxes, and distributing assets to beneficiaries. They must also communicate with beneficiaries and creditors, ensuring transparency throughout the process. Executors are required to act in the best interest of the estate, maintaining accountability and fulfilling all legal obligations. Their role is crucial for the smooth administration and final settlement of the estate.

Responsibilities in Managing the Estate

Managing the estate involves securing and preserving assets, ensuring proper financial oversight, and maintaining clear communication with beneficiaries and creditors. Executors must organize estate finances, manage ongoing expenses, and ensure assets are safeguarded. They are also responsible for preparing an inventory of assets and liabilities, which must be filed with the court if required. Effective communication and transparency are essential to maintain trust and fulfill legal obligations. Proper management ensures the estate is administered fairly and efficiently, adhering to the deceased’s wishes and legal standards.

Notification and Communication

Probate requires notifying beneficiaries, creditors, and financial institutions about the estate’s status. Clear communication ensures transparency, fulfilling legal obligations, and maintaining trust throughout the process.

Notifying Beneficiaries

Notifying beneficiaries is a critical step in the probate process. Executors must inform all beneficiaries named in the will about the estate’s status. This notification ensures transparency and compliance with legal requirements. Beneficiaries should receive detailed information about their entitlements, the probate timeline, and any legal rights they may have. Proper documentation, such as proof of notification, should be maintained. Open communication helps prevent disputes and ensures a smooth distribution of assets according to the deceased’s wishes.

Informing Creditors

Informing creditors is a legal requirement in Manitoba probate for small estates. Executors must notify all known creditors about the estate’s probate, typically through formal notices or advertisements. Creditors usually have a specific timeframe, often several months, to submit claims. Proper documentation and proof of notification are essential to ensure compliance with Manitoba’s probate laws. Failing to notify creditors can lead to legal complications, emphasizing the executor’s responsibility to manage the estate’s liabilities effectively and prevent future disputes.

Asset Distribution

Asset distribution in Manitoba probate for small estates involves transferring property according to the will or legal guidelines, ensuring fair allocation among beneficiaries and resolving any disputes efficiently.

Handling Assets According to the Will

Handling assets according to the will in Manitoba probate for small estates involves identifying, valuing, and distributing property as per the deceased’s instructions. The executor ensures debts and taxes are paid before allocating remaining assets to beneficiaries. Specific gifts are distributed first, followed by residual estate distribution. Beneficiaries must be notified, and disputes resolved promptly. Legal advice is recommended for complex cases to ensure compliance with Manitoba’s probate laws and avoid delays in the process.

Distribution Without a Will

In Manitoba, when there’s no will, the estate is distributed according to intestacy laws. The spouse typically receives a preferential share, with remaining assets divided among children, parents, or siblings. If no relatives are found, the estate goes to the Crown. The executor ensures assets are allocated fairly, following legal guidelines. Disputes may arise, requiring court intervention. The process is systematic, aiming to reflect the deceased’s presumed intentions and maintain family harmony, even without a will dictating the distribution.

Avoiding Probate

Avoiding probate in Manitoba can simplify estate management, reducing legal fees and time. Methods include joint ownership, trusts, and naming beneficiaries to bypass probate requirements effectively.

Methods to Bypass Probate for Small Estates

To bypass probate for small estates in Manitoba, consider joint ownership of assets, which automatically transfer to the survivor upon death. Trusts, such as living trusts, can also hold assets outside of probate. Additionally, naming beneficiaries for retirement accounts, life insurance policies, and investments ensures these assets pass directly to heirs. Gifting strategies during one’s lifetime may further reduce the estate’s value, potentially qualifying it for simplified probate processes. These methods streamline estate management, reducing legal fees and time spent on probate formalities.

Thresholds for Simplified Processes

In Manitoba, estates valued at less than $10,000 may qualify for a simplified probate process known as Summary Administration. This threshold allows for a more straightforward and cost-effective approach, reducing the need for extensive legal proceedings. Estates meeting this criterion can bypass traditional probate formalities, enabling quicker distribution of assets to beneficiaries. This streamlined process is designed to alleviate administrative burdens for smaller estates, ensuring efficiency while adhering to legal requirements. It is an advantageous option for those managing estates with limited assets.

Common Mistakes to Avoid

Failing to properly notify beneficiaries or missing legal deadlines can lead to delays and additional costs in the probate process for small estates in Manitoba.

Pitfalls in the Probate Process

Common pitfalls include missing legal deadlines, incorrect form submissions, and failure to notify all beneficiaries and creditors. Executors may also overlook asset valuation or mismanage estate debts. Additionally, poor communication with stakeholders can prolong the process. It’s crucial to avoid these errors to prevent legal complications and ensure a smooth probate process for small estates in Manitoba.

Consequences of Errors

Errors in the probate process can lead to legal complications, delays, and financial penalties. Incorrect filings or missed deadlines may result in court interventions or additional fees. Beneficiaries could face prolonged waits for asset distribution, while unresolved issues may escalate into disputes. Executors may also face personal liability for mistakes made during estate administration. It’s essential to address errors promptly to avoid these consequences and ensure a smooth probate process for small estates in Manitoba. Professional guidance can help mitigate risks and prevent costly oversights.

Additional Resources

For further guidance, consult the Manitoba Probate Guide, visit the Archives of Manitoba, or explore online legal databases for detailed estate planning and probate information;

- Manitoba Probate Guide

- Archives of Manitoba

- Online legal databases

- Legal aid contacts

- Library resources

- Professional advisors

Where to Find More Information

For comprehensive guidance on Manitoba probate for small estates, consult the Manitoba Probate Guide, which outlines processes, forms, and legal requirements. Additional resources include the Archives of Manitoba, offering historical estate files, and online legal databases like WorldCat for library materials. Professional advisors and legal aid services provide personalized support. Visit the Manitoba courts website for updated forms and procedures. Local libraries and community legal clinics also offer access to probate-related materials and expert consultations.

Seeking Professional Help

For complex cases, consider hiring a probate lawyer or estate planner to guide you through Manitoba’s legal requirements. Professional advisors can help navigate intricate processes, ensure compliance, and resolve disputes. The Manitoba Probate Guide recommends consulting legal experts for personalized advice. Additionally, local legal clinics and the Manitoba Courts website offer resources and contacts for professional assistance. Hiring a professional ensures accuracy and efficiency, especially for estates with contested wills or unusual assets, preventing costly delays or legal complications.