The J.P. Morgan Guide to Markets provides a comprehensive analysis of market trends, economic indicators, and investment strategies. It offers clear charts and graphs to help investors make informed decisions in volatile markets.

1.1 Overview of the Guide

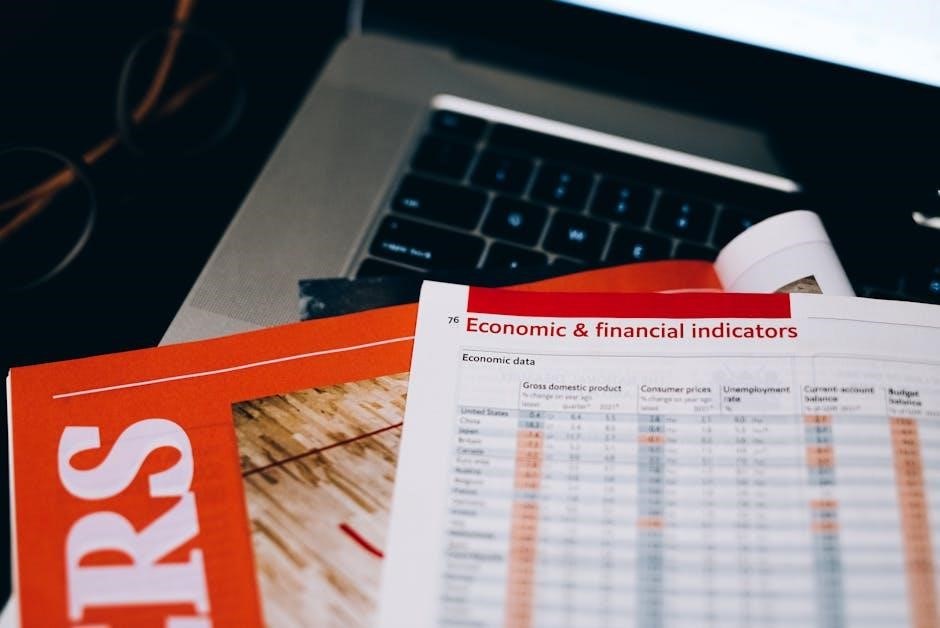

The J.P. Morgan Guide to Markets is a comprehensive resource offering insights into market trends, economic data, and investment strategies. It provides detailed analysis through clear charts and graphs, covering equities, fixed income, ETFs, and macroeconomic indicators. Designed to support informed decision-making, the guide helps investors navigate volatile markets by delivering data-driven insights and expert perspectives. Regular updates ensure relevance, making it an essential tool for understanding global market dynamics and identifying opportunities.

1.2 Importance of Market Intelligence

Market intelligence is crucial for navigating today’s volatile markets, offering insights into trends, risks, and opportunities. The J.P. Morgan Guide to Markets provides high-frequency data and expert analysis, enabling investors to make informed decisions. By leveraging macroeconomic data, policy developments, and sector performance, the guide helps mitigate risks and identify growth potential. Staying informed with timely market intelligence is essential for adapting to changing conditions and achieving long-term investment goals in dynamic financial environments.

Key Market Trends and Insights

Markets are experiencing dynamic shifts, with equities showing mixed performance, fixed income adapting to rate changes, and ETFs driving innovation. Economic data and interest rates remain critical influencers.

2.1 Equity Market Performance

Equity markets have shown mixed performance, with the S&P 500 reaching new highs in January, supported by strong growth and jobs data. However, broader market growth has been modest, with mega-cap tech stocks, such as the “Magnificent 7,” outperforming significantly, posting a 27.7% year-over-year increase in pro-forma earnings compared to 9.4% for the rest of the market. This highlights the dominance of tech giants in driving equity market gains amid broader economic uncertainty.

2.2 Fixed Income and Interest Rates

Fixed income markets remain sensitive to central bank policies, with the Fed’s rate hikes impacting bond yields. Interest rates and inflation trends are closely monitored, particularly as rate hiking cycles near completion. The 10-year Treasury yield reflects economic expectations, while investment-grade bonds offer relative stability. J.P. Morgan’s analysis highlights the importance of understanding these dynamics to navigate fixed income investments effectively amid ongoing monetary policy shifts and inflationary pressures.

2.3 ETF Market Growth and Innovation

The ETF market continues to demonstrate robust growth, with innovative products catering to diverse investor needs. Recent developments include the rise of option-based ETFs and funds targeting specific market segments. These products offer unique payoff structures and exposure to emerging trends, attracting both institutional and individual investors. J.P. Morgan highlights the importance of such innovations in diversifying portfolios and providing targeted market exposure, making ETFs a key tool for modern investment strategies.

Economic Indicators and Analysis

The J.P. Morgan Guide to Markets offers detailed insights into key economic indicators, including macroeconomic trends, sector performance, and market statistics, enabling informed investment decisions.

3.1 Macroeconomic Overview

The J.P. Morgan Guide to Markets provides a detailed macroeconomic overview, highlighting global growth trends, labor market dynamics, and inflationary pressures. It examines key indicators such as GDP growth, employment rates, and consumer confidence, offering insights into the economic landscape. The guide also explores the impact of monetary policies and geopolitical events on market stability, helping investors navigate complex economic conditions effectively.

3.2 Sector Performance and Trends

The J.P. Morgan Guide to Markets highlights strong performance in the technology and healthcare sectors, driven by innovation and demographic trends. The Samp;P 500 shows robust growth, with mega-cap tech stocks outperforming. Emerging markets exhibit varied trends, with infrastructure and consumer sectors gaining traction. The guide also underscores the rise of ETFs, particularly in actively managed and option-based strategies, reflecting evolving investor preferences and market dynamics.

Investment Strategies in Volatile Markets

Diversification, active management, and risk mitigation are key strategies highlighted in the J.P. Morgan Guide to Markets for navigating volatile markets effectively while balancing growth and stability.

4.1 Portfolio Management Techniques

The J.P. Morgan Guide to Markets emphasizes several portfolio management techniques to navigate volatility. Diversification across asset classes is crucial to reduce risk. Active management strategies, such as dynamic rebalancing and tactical adjustments, help align portfolios with market conditions. Additionally, the guide highlights the importance of stress testing and scenario analysis to prepare for potential market downturns. Tax-efficient strategies and regular portfolio reviews are also recommended to optimize returns and maintain long-term investment goals.

4.2 Risk Considerations and Mitigation

Understanding and managing risk is critical in volatile markets. The J.P. Morgan Guide to Markets highlights key risks such as market volatility, geopolitical tensions, and interest rate fluctuations. Mitigation strategies include diversification across asset classes, hedging techniques, and stress testing portfolios. Regular monitoring of equity market performance and fixed income dynamics is essential. Additionally, the guide emphasizes the importance of maintaining liquidity and adjusting allocations to align with risk tolerance and investment objectives.

J.P. Morgan’s Market Outlook

J.P. Morgan’s Market Outlook provides a comprehensive analysis of global market trends, offering forward-looking insights and strategies. It covers economic trends, market dynamics, and potential opportunities for investors.

5.1 Global Market Insights

J.P. Morgan’s Global Market Insights provide a detailed analysis of worldwide economic trends and market dynamics. The guide highlights key themes such as market volatility, U.S. policy announcements, and global growth slowdowns. It also addresses risks associated with geopolitical tensions and inflationary pressures. Additionally, the insights cover equity market performance, fixed income trends, and emerging market opportunities, offering a holistic view of the global economic landscape for informed investment decisions.

5.2 Thought Leadership and Expert Analysis

J.P. Morgan’s thought leadership and expert analysis offer actionable insights into market trends and economic conditions. The guide features commentary from leading economists and market strategists, providing perspectives on equity performance, fixed income dynamics, and ETF innovations. Experts discuss portfolio management techniques, risk mitigation strategies, and long-term investment opportunities, ensuring investors stay informed and ahead of market shifts. This expertise helps navigate complex financial landscapes with confidence.

Regional Market Analysis

The guide provides insights into global markets, focusing on developed and emerging regions. It highlights U.S. growth, European stability, and emerging market trends, including China’s recovery.

6.1 Developed Markets Overview

Developed markets, such as the U.S. and Europe, demonstrate resilience amid global uncertainty. The S&P 500 reached new highs in early 2025, driven by strong economic data. Domestic orders in the U.S. increased, reflecting a shift toward local alternatives, while export orders declined slightly. Mega-cap tech stocks outperformed, with earnings growth surpassing broader market averages. The J.P. Morgan Guide highlights these trends, offering insights into regional dynamics and investment opportunities in developed economies.

6.2 Emerging Markets Trends

Emerging markets face mixed performance amid global economic shifts. J.P. Morgan highlights growing interest in regions with strong consumer demand, such as Latin America and parts of Asia. However, challenges like currency fluctuations and geopolitical risks persist. The JPMorgan Emerging Markets Investment Trust PLC reported a negative gearing ratio, signaling cautious investment approaches. These markets offer long-term growth potential but require careful navigation due to volatility and structural complexities, as outlined in the J.P. Morgan Guide to Markets.

Current Market Challenges

Rising U.S. national debt and market volatility remain significant concerns. J.P. Morgan highlights risks from global economic shifts and geopolitical tensions, impacting investment stability and growth prospects.

7.1 Market Volatility and Uncertainty

Market volatility persists amid global economic uncertainty, with policy announcements and geopolitical tensions amplifying risks. J.P. Morgan notes heightened instability in equity and crypto markets, despite recent corrections. The potential approval of spot Bitcoin ETFs has sparked enthusiasm but also caution. Investors face challenges navigating fluctuating interest rates and slowing global growth. J.P. Morgan emphasizes the importance of diversified portfolios and robust risk management strategies to mitigate these uncertainties and capitalize on emerging opportunities in volatile conditions.

7.2 U.S. National Debt Concerns

The rising U.S. national debt has sparked significant concerns, with JPMorgan Chase CEO Jamie Dimon highlighting its potential impact on economic stability. The increasing debt levels pose risks such as higher borrowing costs and reduced fiscal flexibility. Market volatility and investor sentiment are also influenced by debt-related uncertainties. J.P. Morgan emphasizes the need for proactive financial planning and portfolio diversification to mitigate these risks, ensuring resilience against potential economic challenges stemming from debt pressures.

Future Market Outlook

The guide highlights key themes for Q2 2025 and long-term investment opportunities, emphasizing potential market growth and emerging trends shaping the financial landscape.

8.1 Key Themes for Q2 2025

Key themes for Q2 2025 include navigating policy-driven market volatility, monitoring interest rate trends, and assessing inflation expectations. Investors should focus on sectors poised for growth amid slowing global expansion. The guide emphasizes identifying opportunities in innovative markets, such as ETFs and emerging technologies, while managing risks associated with geopolitical uncertainties and debt concerns.

8.2 Long-Term Investment Opportunities

Long-term investment opportunities focus on sectors with strong growth potential, such as renewable energy, technology, and healthcare. Investors should consider diversifying portfolios to capture innovation-driven returns. Emerging markets offer promising prospects due to structural reforms and demographic trends. Additionally, ETFs and actively managed funds provide access to targeted exposures. Balancing risk and reward remains critical, as highlighted by J.P. Morgan’s market insights, to capitalize on sustainable growth over the next decade.

The J.P. Morgan Guide to Markets offers a detailed analysis of market trends, economic indicators, and investment strategies. It provides insights into equity performance, fixed income dynamics, and ETF growth. The guide also covers regional market trends and future outlooks, helping investors navigate complex financial landscapes. By leveraging expert analysis and data-driven insights, the guide equips investors with the tools to make informed decisions in an ever-evolving market environment.